The Department accepts both the 12-digit permit number and 9-digit permit number when filing withholding returns, W-2s, and 1099s.

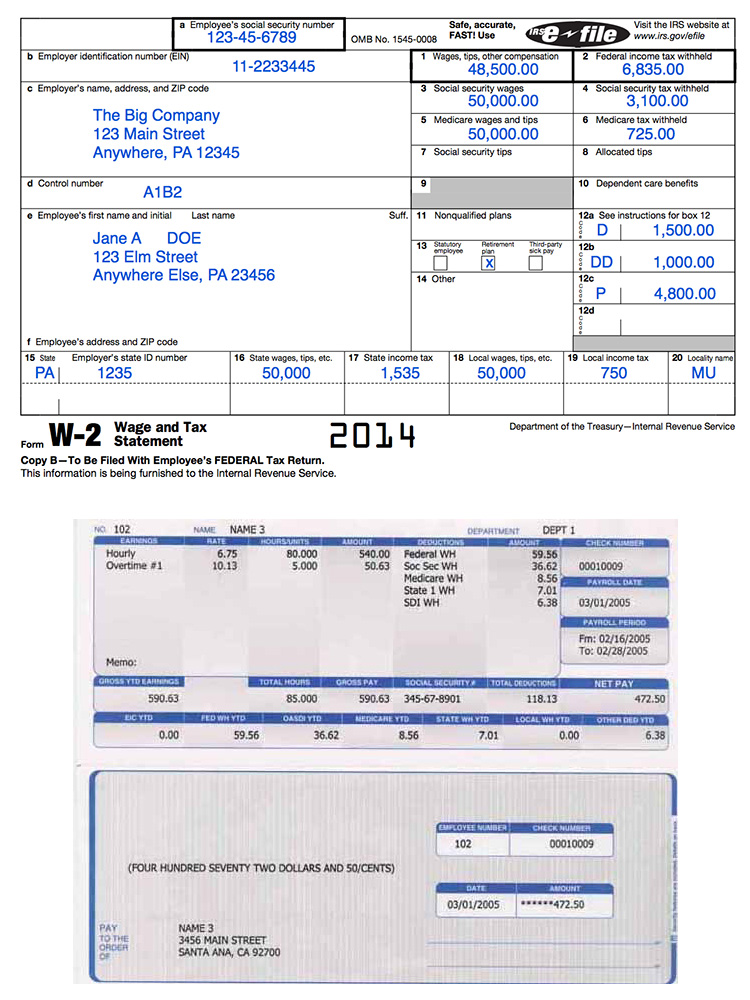

12-digit numbers were previously assigned to permits issued before November 15, 2021. The Department recommends using the 9-digit permit number when possible. What Permit Number should you use to file?Īll withholding permits are assigned a 9-digit permit number. If businesses did not withhold any Iowa taxes in 2021, filing is not required. This data is an essential tool the Department uses to increase the accuracy of tax refunds and detect tax refund fraud during the current income tax filing season. W-2s and 1099s must be filed using GovConnectIowa.īusinesses that issued W-2s or 1099s that contain Iowa withholding must electronically file those documents with the Iowa Department of Revenue using GovConnectIowa. Remember, TurboTax, and H&R Block will guide you through getting your W2 form and making sure you get your tax refund as quickly and efficiently as possible.The filing deadline for W-2s and 1099s is February 15. Just remember that when you eventually do get your W-2 or W-2C, you will have to amend your return if the figures used are different from the substitute Form 4852. Alternatively, request Form 4852, which allows you to estimate your wages and deductions based on the final payslip received.

#Date for w2 mailings download#

Once you have contacted them, the IRS will follow up with the employer.įailing that, you can also download Form 4506-T, which has a breakdown of the W-2 information that your employer has reported. It might also help to estimate your earnings and the rough amount of federal income tax deducted from your pay during that time. You will also need the name and complete physical address of the employer, as well as the timeframe of when you worked there. Be sure that you have your name, address, and Social Security number available. If you still don’t have any luck, contact the IRS directly at 80. Again, you can do this easily through TurboTax or H&R Block W2 online import. If you receive a W-2C after importing your W-2 data, change the W-2 information to the “correct information” area on the new document. The importing process is simple, but companies like TurboTax and H&R Block will guide you through any queries you may have and manage the process for you. Many employers provide the option of getting your W-2 information online – check if this is the case in your workplace.If you don’t feel confident, request another copy.Confirm your mailing address and details, right down to the spelling of the street name.Be sure to confirm the date it was sent, too. Check that your employer, previous or current, has mailed the form.Here are a few things you can do to try and speed up the process to get your refund: The difference is that payslips only provide monthly details, whereas the W-2 is a record of the entire year.Īlthough the IRS has a guideline of 2 weeks for postal delivery of your W-2 documents, this doesn’t mean that you need to sit and wait for it to arrive.

The document provides detailed information about your entire year’s wages and any taxes that have been withheld, which is essential for you to file your return.Ī copy of the document also needs to be sent to the IRS because a payslip is different from a W-2. Here are your rights when it comes to getting the correct documents on time.Īll employers are legally obligated to send your W-2 to you no later than January 31 st of each calendar year.

#Date for w2 mailings how to#

0 kommentar(er)

0 kommentar(er)